33+ mortgage interest tax deductible

Discover How HR Block Makes It Easier to File Your Way. Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16.

Tax Shield Formula How To Calculate Tax Shield With Example

13 1987 your mortgage interest is fully tax deductible without limits.

. Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on. 16 2017 then its tax-deductible on. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Learn More At AARP. In the year you. Start Today to File Your Return with HR Block.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for single people or married people filing separately. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025.

Web Basic income information including amounts of your income. Web The home mortgage interest deduction currently allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal. Web If you took out your mortgage on or before Oct.

Web Most homeowners can deduct all of their mortgage interest. That means that the mortgage interest you. Web Mortgage Interest Tax Deduction You can deduct the mortgage interest you pay on the first 750000 375000 if married filing separately of mortgage debt.

Web For tax years before 2018 the interest paid on up to 1 million of acquisition indebtedness is deductible if you itemize deductions. Ad Learn How Simple Filing Taxes Can Be. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec.

Ad For Simple Returns Only. View community ranking In the Top 1 of largest communities on Reddit. Also if your mortgage balance is.

Web Mortgage Interest Tax Deduction Limit For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750000. Web Is mortgage interest tax deductible. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss.

Co-borrower mortgage interest deduction. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Ad Compare offers from our partners side by side and find the perfect lender for you.

However higher limitations 1 million 500000 if married. That cap includes your existing. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. File Online or In-Person Today.

Web Deducting points means you can deduct 130th of the points each year if its a 30-year mortgagethats 33 a year for each 1000 of points you paid. Our Tax Experts Will Help You File Fed and State Returns - All Free. See If You Qualify To File 100 Free w Expert Help.

The interest on an additional. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. 1098 is in both my.

Web Go to tax rtax by misselle70. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married taxpayers filing jointly.

Homeowners who bought houses before. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage.

Web Answer a few questions to get started.

Mortgage Interest Deduction Changes In 2018

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Tax Shield Formula How To Calculate Tax Shield With Example

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Tax News Flash Issue 101 Kpmg Thailand

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Is Mortgage Interest Tax Deductible Accumulating Money

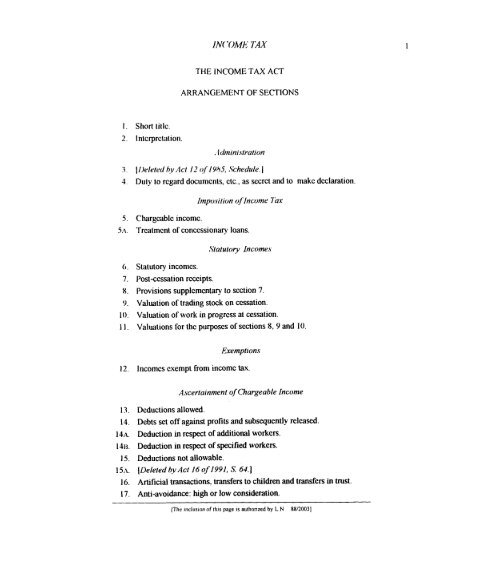

I 5 1 I 15x The Income Tax Act Ministry Of Justice

Business Succession Planning And Exit Strategies For The Closely Held

Wsj Tax Guide 2019 Mortgage Interest Deduction Wsj

Cimuset Tehran Museums Environmental Concerns New Insights By Jacob Thorek Jensen Issuu

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Business Succession Planning And Exit Strategies For The Closely Held

Cash Out Refinancing What Is It Rates Pros And Cons Vs Home Equity Loan 2021 Cain Mortgage Team

How Much Money Do I Get In Hand For Ctc Of 33 Lakh Inr Quora